Banks embedding sustainability pay less for capital, UNFI says

Half of global banking assets now aligned with responsible banking principles

The United Nations Environment Programme Finance Initiative (UNEP FI) said in its latest Principles for Responsible Banking (PRB) Progress Report that banks aligned with the framework are realising measurable financial benefits, paying about one percentage point less for equity and debt capital than peers.

Launched in 2019, the PRB framework now covers more than 350 banks across 87 countries, representing nearly half of global banking assets.

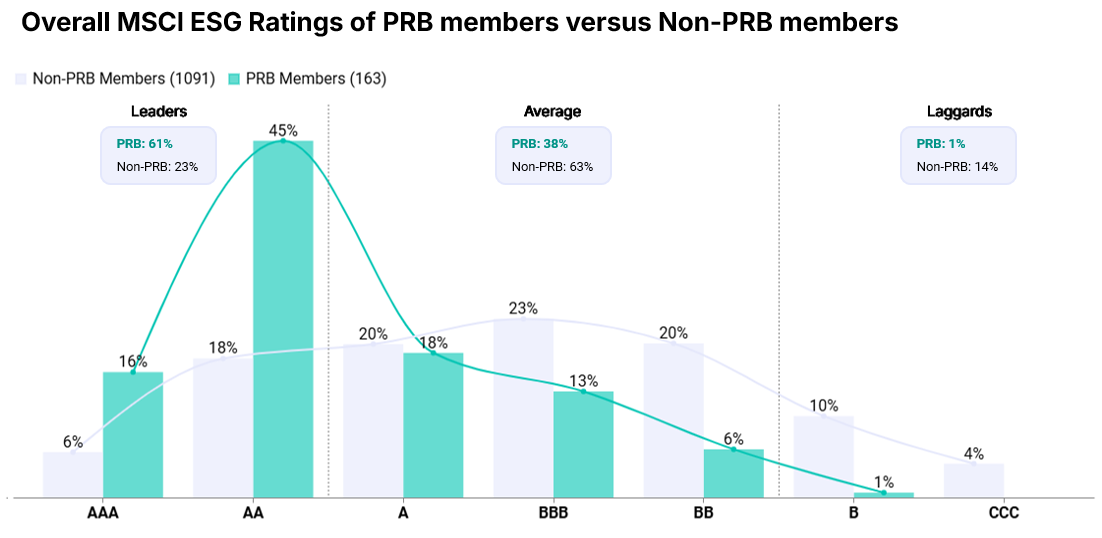

Citing analysis by the MSCI Sustainability Institute, UNEP FI said 61% of PRB banks outperform peers in managing sustainability risks, compared with 23% of non-signatories. The findings indicate that integrating sustainability factors into strategy and governance enhances operational resilience and investor confidence.

The report also pointed to growing regulatory alignment with UNEP FI’s methodologies, including impact analysis and sustainability target-setting. In Asia-Pacific, regulators in eight of 12 jurisdictions have incorporated sustainability into financial mandates, reflecting the spread of responsible banking practices into mainstream supervision.

Despite the progress, UNEP FI said sustainability integration remains inconsistent across markets. Data limitations and evolving policy frameworks continue to constrain disclosure quality. UNEP FI Head Eric Usher said coordinated action among regulators, banks, and civil society is critical to advancing a resilient, low-carbon global economy.