Uneven access to green finance slows global corporate climate action

Eight in 10 CEOs plan to sustain sustainability investment despite financing gaps.

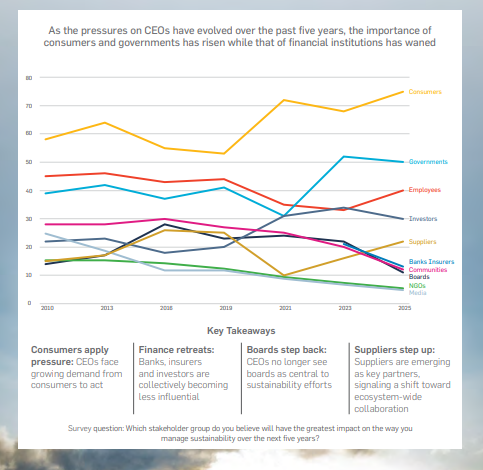

Global companies are expanding sustainability spending even as weak regulation and uneven access to green finance constrain progress, according to the 2025 UN Global Compact–Accenture CEO Study released on Wednesday.

Only 35% of the United Nations Sustainable Development Goals are on track, underscoring the gap between stated commitments and measurable outcomes, according to the survey. It also shows that corporate sustainability is now embedded in most business operations, but inconsistent policy and financing remain the main barriers to scaling results.

The study of nearly 2,000 chief executives across 120 countries found 84% plan to maintain and prepare for sustainability investment.

Corporate integration has expanded: 86% of companies have built environmental and social objectives into core operations, and 59% link management pay to sustainability metrics. However, only 25% of CEOs rank technology and innovation among their top business priorities, despite 97% identifying them as essential for performance and compliance.

Sustainable finance remains a constraint, according to the report. 80% of CEOs reported improved access to capital in recent decades, but only 55% expect continued growth. Over 140 countries, representing 90% of global GDP, have adopted net-zero targets, though most funding is concentrated in advanced economies.

“When regulation supports sustainability, capital follows,” Nikolaj Sørensen, chief executive of Sweden’s Orexo AB, said in the report.

The study indicates that companies are likely to pursue targeted efficiency measures, including supply-chain emissions reduction and stricter reporting standards, while broader transformation will depend on clearer regulatory alignment and wider financial participation.