Green M&A deals exceeding $100M up by over 60% in last decade

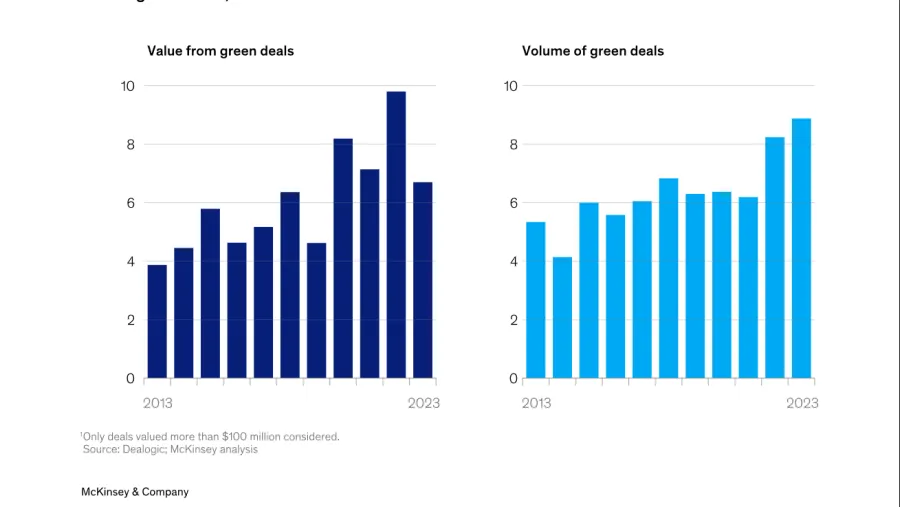

The share of green deals have increased both in value and in volume.

The share of green M&A deals valued at over $100m has increased by 66% in 2023, McKinsey reported.

The volume of green deals over the said period stood at 8.9%, up from 5.3% in 2013. The value of green deals likewise saw an upward trend to 6.7% from 3.9%.

“The past ten years show a rising share of green deals in many sectors, albeit from different starting positions,” the report read in part.

“The trend toward green M&A is observed most frequently in sectors related to energy and materials, such as electric power and chemicals, but other sectors—such as automotive, construction, consumer electronics, food, and financial institutions—are increasingly participating as well.”

For instance, the share of green deals in the utility and energy sector rose to 35% in terms of volume from 27%. In the automotive sector, green deals accounted for 14% of the deal volume, up from 8%.