China dominates Asia’s green finance

However, China’s “supply-first” strategy to green transition may face limits.

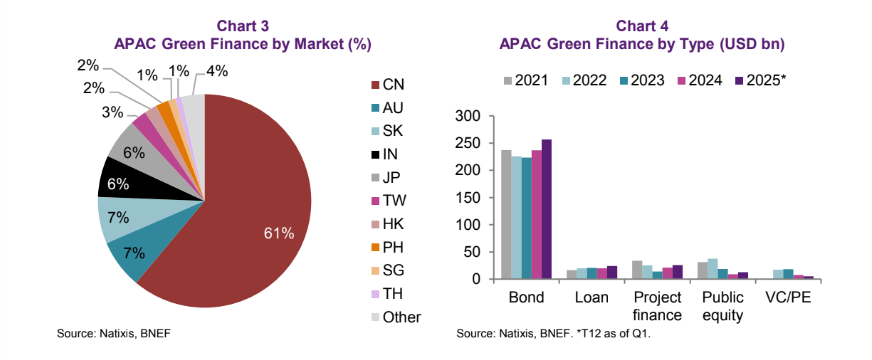

China accounts for 60% of Asia’s green finance, which translates to $200b, according to a report by Natixis CIB.

Other major contributors are Australia, South Korea, India, and Japan, with annual funding of around $20b each.

Most of the region’s funding comes through fixed income, which makes up 80% of all deals.

The report noted that China’s green technology sector used to find it easy to fund its investment through retained earnings, but falling profits are widening the funding gap.

At the same time, the government is driving a new round of ultra-high voltage (UVH) transmission construction to ease renewable energy bottlenecks, a costly expansion that has added to financing needs.

For example, State Grid Corporation’s bond issuance soared by 250% to $44b in 2024, making it the world’s largest green bond issuer since 2021.

Despite its scale, the report also noted that China’s “supply-first” push faces limits.

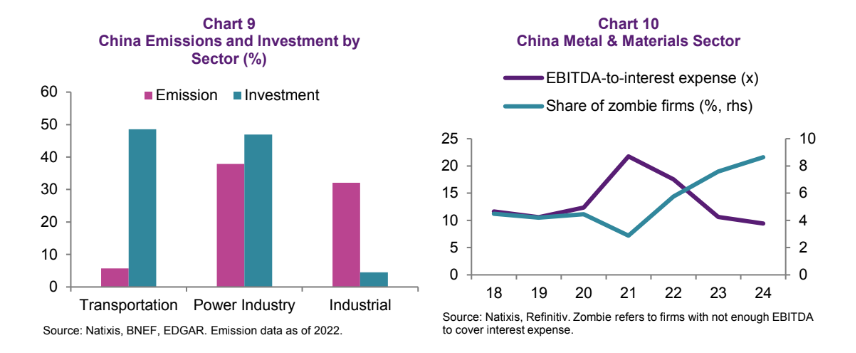

Most subsidies have gone to clean transportation, whilst industrial decarbonisation lags due to a lack of funding.

As China brings steel, aluminium, and cement into its carbon trading scheme, demand for transition financing in these sectors is expected to rise sharply.

“All in all, the strong rebound in green bond issuance since 2024 is expected to continue in China,” the report said. “Given firms’ increasing demand for transition financing and pervasive lower returns in China, green finance may be the next sweet spot for debt investors.”