Vessels capable of using low carbon fuels enter service as supply lags far behind

Accelleron positioned Asia Pacific as a proving ground for carbon-neutral shipping fuels.

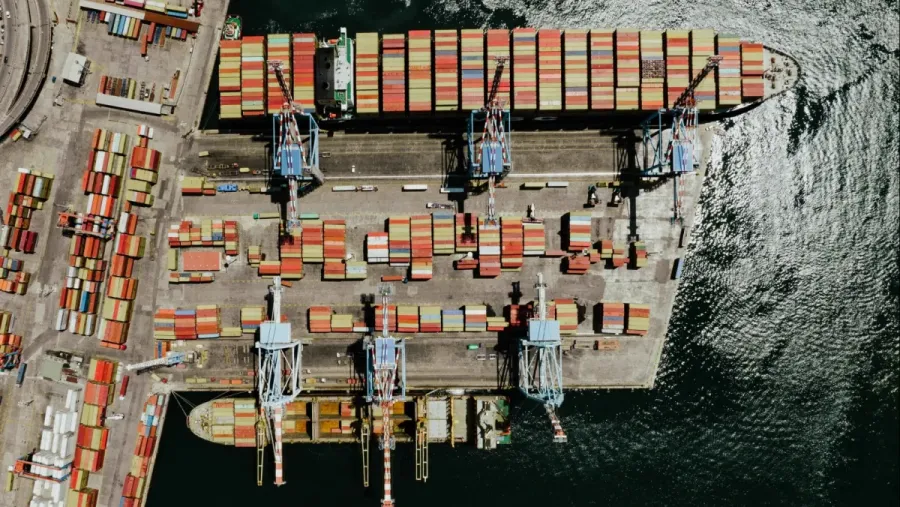

Vessels capable of using low-carbon fuels are starting to enter service, but fuel supply is not keeping pace, according to a report from Accelleron.

The study said cross-sector initiatives involving energy producers, industry, and ports are progressing, yet supply remains far below what maritime demand will require.

Accelleron positioned Asia Pacific as a proving ground for carbon-neutral shipping fuels. It said shipping will need 100 to 150 million tonnes of green hydrogen a year by 2050, within a wider 500 to 600 million tonnes required across hard-to-abate sectors.

Current plans amount to only about 38 million tonnes, backed by roughly US$320b of investment.

The report outlined five “deadlocks” slowing the transition. These include uncertainty over fuel pathways, the concentration of early e-fuel supply in a few regions, limited green-finance flows into maritime fuels, weak or absent carbon pricing and demand incentives for shipping, and uneven port readiness that confines early bunkering to a small group of hubs.

Accelleron said Asia Pacific shows several differentiators. Modular e-fuel production is advancing, including China’s Chifeng project in Inner Mongolia, which produces about 300,000 tonnes of e-ammonia a year and targets 1.5 million tonnes by 2028 at reported FOB prices below US$700 per tonne.

Japan, Korea, Singapore, Australia, and the EU are developing book-and-claim and guarantees-of-origin schemes to bridge early distribution gaps. Port roles are becoming clearer, with Australia and parts of China emerging as producers, Japan and Korea as receivers, and Singapore as a connector.

Singapore features prominently. It is the only Asia Pacific economy with a carbon tax that affects shipping and provides port dues and registry incentives.

It is running ammonia and methanol pilots and progressing FEED studies for 55 to 65 megawatts of ammonia-to-power capacity and at least 100,000 tonnes a year of ammonia bunkering on Jurong Island.

Accelleron said these steps position Singapore as an early net-zero bunkering hub.

Other early movers include Shanghai, Busan, and Yokohama, which are piloting methanol and ammonia and building operational readiness.

Most other ports, the report said, still lack the economics, bunkering vessels, trained workforce, and procedures needed to go beyond pilot phases.

On alternatives, Accelleron said nuclear propulsion, including molten-salt small modular reactors, is unlikely to scale before 2050 because of technical, regulatory, and social hurdles.