Private capital faces $1t opportunity amidst demand for climate resilience tech

Attractive themes include flood management, resilient agriculture, and financial-risk transfer.

McKinsey & Company estimates a possible $1t opportunity for private capital by 2030, given growing demand for technologies that support climate resilience and adaptation.

"Overall, private capital activity in climate adaptation and resilience has been materially lower compared with investment in decarbonisation and mitigation," McKinsey noted.

"As of June 2025, less than $8b had been raised for investments in resilience from fewer than 120 dedicated climate resilience funds, whereas more than $650b had been raised for decarbonisation and broader sustainability investments from more than 1,300 private funds.

"Although private capital in this area is beginning from a small base, it's starting to mobilise around climate resilience as an attractive theme. Larger firms are making investments dedicated to adaptation and resiliency, often out of their existing climate funds."

In 2024, 11% of investments in climate resilience came from private capital sources. The 89% majority was backed by public and philanthropic funding.

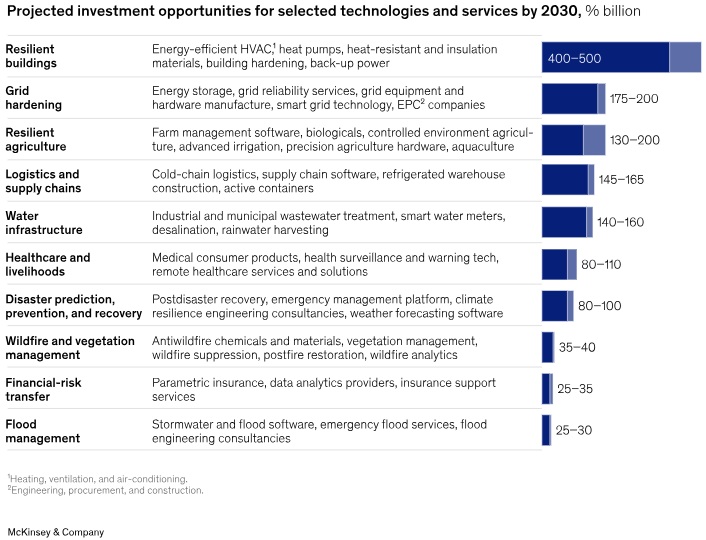

"For corporate executives and investors of private capital, we estimate technologies that support climate resilience could represent addressable markets worth $600b to $1t by 2030," said McKinsey, which quantified the near-term opportunity to help potential investors.

According to McKinsey, the following technology categories represent attractive investment opportunities: building resilience; grid hardening; logistics and supply chain; water infrastructure; resilient agriculture; healthcare and livelihood; disaster prediction, prevention, and recovery; wildfire and vegetation management; financial-risk transfer; and flood management.

Of the various adaptation technologies under these categories, McKinsey identified 49 mature ones that are most likely to see strong customer adoption whilst being well positioned to address future climate hazards.

McKinsey stated: "Whilst the prioritised opportunities are just a subset of the broader investment need for climate resilience, we estimate that the 10 themes and 49 technologies... represent a $600b to $1t addressable market by 2030, with an average annual growth rate of 7 to 11%.

"The scale of these addressable markets and their exposure to several tailwinds beyond climate change alone should warrant attention from a range of investors and leaders across the public and private sectors."