How firms can navigate geopolitical risks

Firms must thrive and not just survive, according to McKinsey.

Business leaders said geopolitical tensions are the biggest risk to economic growth, according to the latest McKinsey Global Survey.

McKinsey said firms should consider tailoring their growth strategies, core business operations, technology stacks, talent footprints, and capital asset portfolio to thrive and not just survive.

For example, a North American medical devices company that shifts its manufacturing operations and supply chain to Mexico from another country to take advantage of trade agreements could save 15% to 25% on operating costs.

Mckinsey noted that a few advanced companies are exploring ways to create value amidst geopolitical disruption by finding opportunities to accelerate growth, optimise business operations, and develop strategies to address global disruption.

“As geopolitical conditions change, companies may be able to attract new customers and capture more market share,” McKinsey said.

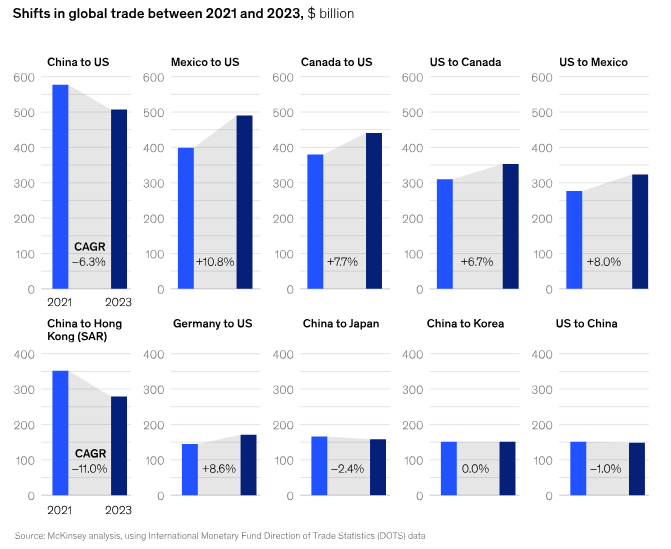

As such, current shifts in trade corridors are already reshaping industries. Data from the International Monetary Fund shows substantial changes across the top trade routes between 2021 and 2023, mostly between China and the United States.

Other research shows that net foreign direct investment inflows to China decreased to $42.7b in 2023 from $344b in 2021, the lowest in three decades. Analysts predict this will likely accelerate over the next decade.

Moreover, one of the most important decisions is where the company will invest in its manufacturing, storage, and customer engagement activities as these can shape the company’s trajectory.

For instance, Samsung factored in favourable trade agreements, competitive labour costs, and the strategic location of Vietnam when investing $2b in additional manufacturing capacity. Meanwhile, Apple, which had traditionally based its manufacturing in China, has diversified its manufacturing footprint.

Furthermore, information and technology leaders need to continually assess their technology and data footprints to hedge against shocks and remain resilient.

Online giant Google chose to build data centres in Finland to harness the country’s abundant renewable energy resources and to move the company closer to achieving its stated sustainability and carbon-neutrality goals.

Additionally, companies must anticipate the impact of potential laws, policies, and regulations. Without this foresight, multinationals may be subject to forced market exits.

For example, BP exited Russia three days after the war in Ukraine began, leaving behind its holdings in Russian oil and gas company Rosneft. As a result, BP had to take a charge of more than $24b in its accounts and its earnings were reduced by $2b a year.